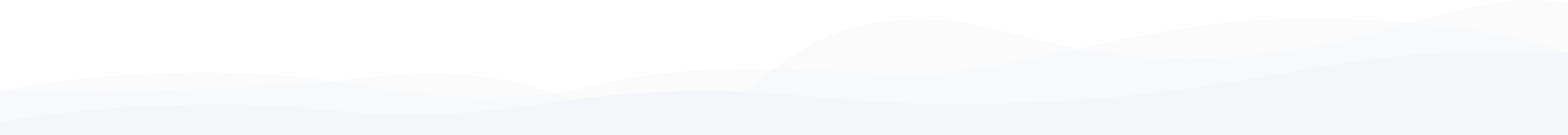

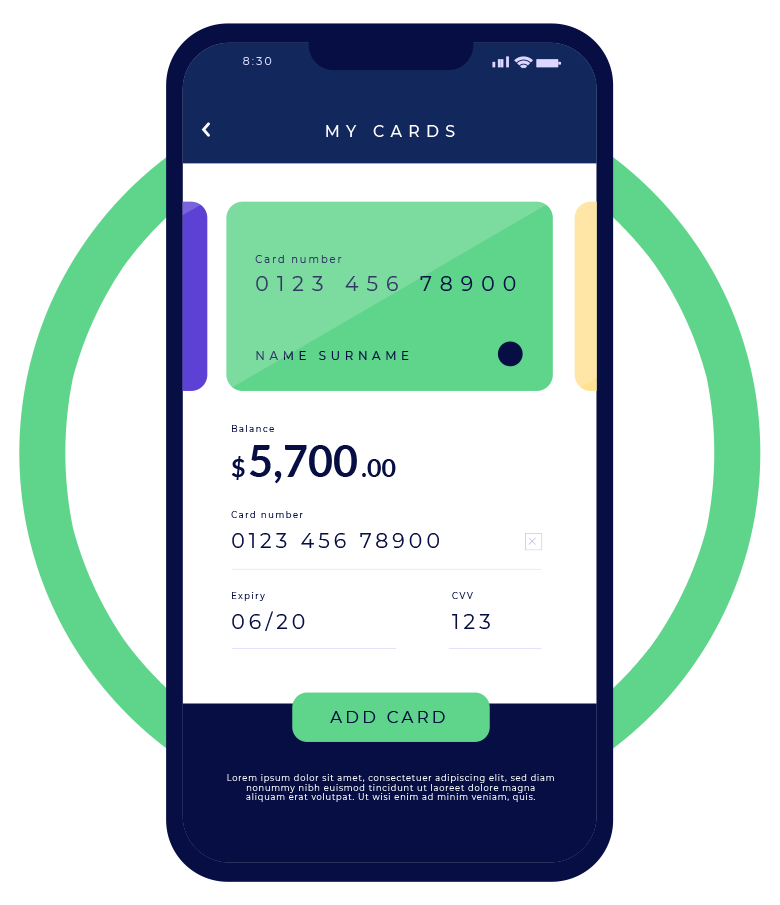

HOW IT WORKS

You track your

income and expense in one step

KEY FEATURES

we bring clarity, create awareness, and offer professional advisory services to investors seeking lucrative opportunities

Our mission is to promote financial inclusion, economic empowerment, and long-term prosperity by providing expert guidance, market insights, and tailored investment solutions. By filtering through market complexities

Financial services focus

Economic Growth – Financial services help move money through the economy, allowing businesses to grow and create jobs. They support new ideas and businesses, boosting the overall economy and ensuring long-term stability.

Risk Management – Insurance helps protect individuals and businesses from financial loss. By covering unexpected events, such as accidents or health issues, it offers peace of mind during difficult times.

Wealth Management – Investment services help individuals and businesses grow their savings over time. These services make it easier to plan for the future, offering options for saving, retirement, and financial security.

Access to Credit – Loans and mortgages provide people and businesses with the money they need for major purchases or investments. This access to credit supports long-term financial planning and flexibility.

How financial services work

Managing Personal Finances – Banking services help individuals manage their money. Savings accounts keep funds safe, while loans assist with large purchases like homes or cars.

Facilitating Payments and Transfers – Payment services, such as credit cards and bank transfers, make transactions easier. They provide convenience and security for both consumers and businesses.

Investment Opportunities – Investment services help individuals grow their wealth. Platforms like mutual funds and stocks allow people to invest for long-term goals like retirement.

Insurance Protection – Insurance services protect against unexpected risks. Health, life, and property insurance offers financial security for medical costs and emergencies.

Building Credit and Loans – Credit cards and mortgages help build credit and secure loans. They are key for establishing a financial history and getting better rates in the future.

Technology in financial services:

Digital Banking – Technology has made digital banking possible, allowing customers to complete transactions, view balances, and manage accounts online. This innovation provides greater convenience by reducing the need for visits to physical branches.

Mobile Payments – Mobile payment systems like Apple Pay and Google Pay have simplified transactions, making them quicker and more convenient. Users can securely make payments using smartphones, improving both accessibility and efficiency.

Artificial Intelligence (AI) – AI is applied in financial services for customer support, fraud detection, and data analysis. AI tools help businesses personalise customer interactions, automate processes, and identify potential risks.

Cybersecurity – Technology strengthens the security of financial transactions by protecting sensitive data. Strong cybersecurity measures ensure that customers’ financial information remains safe from cyber threats.